[ad_1]

Life science research changes frequently, with new discoveries being published every day. Some of these discoveries form the basis of new biotech companies, but whether or not these companies will be successful can be hard to predict.

Isabelle de Cremoux, CEO of French VC investment firm Seventure Partners, knows this only too well. Seventure was one of the first investment companies to recognize the potential importance of the microbiome to human health and to begin investing in the area. With several companies now at Phase III, and good results coming out of many trials, Seventure’s foresight seems to have paid off. The first microbiome-based therapeutics are set to enter the market this year, regulatory approval permitting.

After studying engineering, law and finance, de Cremoux began her career in 1991 with the holding company Arthur Andersen in Detroit. Following this, she moved away from corporate finance and started working in business development for big pharma and spent a number of years working at Pfizer and Abbott before joining Seventure in 2001 to start a life sciences division. Since 2014 she has led the company as CEO, as well as continuing her life science investment work.

De Cremoux spoke to Inside Precision Medicine senior editor, Helen Albert, about her inspirations, the challenges involved in the unpredictable world of life science investing and about becoming an expert in the microbiome.

How did you get into biotech investing?

By family background, I’m in a family of entrepreneurs, my father is an entrepreneur and my mother founded La-Roche Posay, a cosmetic company. I thought rather than doing management accounting, let’s go into business development, let’s get into the real world of drug development and the core business of the company and that’s how I landed in biotech and pharma. I spent about 10 years in the pharma industry, doing business development, first at Pfizer and then at Abbott. At that point I thought business development is good, but doing it for large companies is further away from the end product and the operations. So, I thought, maybe going to venture capital would allow me to continue doing something very similar to business development, but much closer to the product and to the team and also dealing with smaller companies, which was where my heart was. That’s how I jumped from Abbott at the time to Seventure. I interviewed with many venture capital firms and I chose Seventure because they had no life sciences department at all. And they hired me to create it, which was a nice challenge. And so, I started with a blank page, building a strategy of investment in biotech, starting first with biotech and medtech and then moving on later to what we now call the microbiome.

What differentiates Seventure from other life science venture capital firms?

We started smaller than the bigger established venture capital companies so we had to be different. There was a necessity that we would be different to get the deals and to be able to fundraise and to deploy our funds. I think the USP that I’ve built in the team that I’ve recruited is that we spent a lot of time prior to investing analyzing the deals. We spend a lot of time thinking ahead and considering what segments we want to invest in independently of receiving the deals and simply analyzing them to say yes or no. We try to employ strategic thinking to predict how innovations could join the market, and also think about the payers and the patient and physician communities to include the societal trends. That’s how we identify the different segments where we want to invest.

Why is precision medicine important in your opinion?

For us precision medicine covers many concepts. One concept is the better understanding of the pathologies, in the sense that most of the most of the medical needs that are not yet met, probably can be explained because they are addressing one disease, which in fact is several diseases that should be separated according to different physiological criteria. Second, of course, is stratification of patients, they can segment the patients, because the pathology is not the same, or because they’re responding differently to treatment. The stratification could address the different pathologies or the different response rates. In cancer, which was probably the first indication for precision medicines demonstration of use, there are so many treatments and so many different subcategories of patterns, that there are even some companies whose job is simply having this platform of all the different treatments and all the different phenotypes and biomarkers and helping doctors choose which approach is suitable for which patient. For us, it’s all of this.

Is a precision medicine approach something you look for when you invest?

Yes, of course, some companies are developing treatments with this approach and many companies have enabling technologies to allow for this approach. There are others that have a diagnostics approach, or a stratification approach, or even patented biomarkers that are helping the field to develop. We have Enterome, for example. Enterome’s approach is that they segment patients for example, for chronic diseases. They stratify the patients, because they identified that more than 70% of Crohn’s disease patients have a pattern that has specific bugs. They stratify the patients and give the treatment, which is currently in phase two, to this segment of patients. They also have precision medicine approach in oncology with the same patterns of stratifying patients according to their response rates and microbiome profiles. Axial Biotherapeutics also uses a precision medicine approach. What they have identified is that in autism, with their profiling of the microbiome they can identify different patterns, some of which can be treated. They’ve done a clinical trial on 26 children and teens with spectacular endpoint results treating anxiety, and improving sociability.

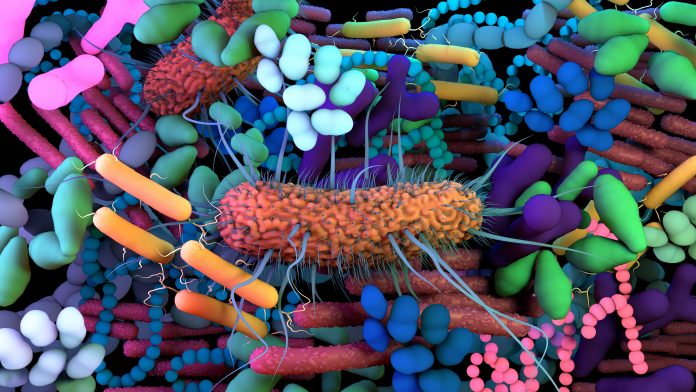

As a company why do you have such a strong focus on the microbiome?

We don’t just invest in the microbiome, but I think the microbiome is our USP. The reasons why we’re interested in the microbiome is because there were research publications that really started to show the link between not only food and drugs, which was our interest for more than a decade, but with the immune system of the person. And it seemed to us that the microbiome was actually the key linking the three. When we understood that the microbiome was linking the three, and especially the immune system, we were like, ‘Wow, maybe that that is opening the door to so many chronic diseases that are not known and therefore not treated or cured currently.’ The more we discovered and learnt about the microbiome, and the more publications there were, the more this thesis was confirmed. After a few years, this thesis, which was originally just an intuition, is now proven publication after publication, and is a reality. Also, a reality from a medical perspective with now products that are in phase three, and that are filed for market authorization. And, and also with business results, because the valuation and the transactions are now good in the microbiome.

It must be satisfying to have predicted this correctly.

Yes. I think we were pioneers in the field, because we just looked at the different pieces of the puzzle, and thought that they really clicked. I decided to really invest time and resources to be ahead, and to be a pioneer in this field. But, as with any innovation in medicine, you have an intuition and you make bets, but sometimes you lose your bets, because sometimes the publications are contradicting your theory. But in the case of the microbiome, it’s indeed very satisfactory to see that after a few years, most of the publications go in the same direction and confirm our assumptions. Of course, there is a few clinical trial failures. But I mean, there’s no field where there is no clinical trial failure at all. And in 2021, there were a few failures in clinical trials, which of course, raised the doubts for the sceptics. But there are also many successful clinical trials. So, I think they are more numerous. And I think late 2022, we will see two market authorizations in the field of the microbiome [for Seres and Fering/Rebiotix], and that will be a turning point…We also have MaaT pharma, which is a company to watch. It’s currently in Phase III, pretty quick for a company that we founded in 2014 from scratch.

In terms of investment, how has investment in this field changed over the last five years?

There has been ups and downs. In the very beginning, it was so pioneering that there were very little VCs. Then some of them made one deal to learn and to see. Then came the bad results of last year, which blocked and froze most of the financial VCs, not the corporates, because they were playing longer term, but the VCs had to step back. When there’s the market authorization, they will all come back again but for this current period, I think we’re ‘on hold.’

On a more personal note, what lessons have you learnt since becoming CEO?

One lesson I think you learn in this venture capital industry is that the natural tendency of this field is that it increases the ego of the investors. Because, of course, as in any buyer role, it’s always more difficult to be vendor than to be a buyer. When you have the money, there’s a tendency of many venture capitalists to lose their personal curiosity and their personal humility. It’s more difficult to be an entrepreneur than to be a venture capitalist, but sometimes venture capitalists tend to forget that. And the lesson that I learned through this journey is if you want to be a really good investor, you’d better not lose this intellectual curiosity about new businesses. If you think you’re better at execution and strategy than the entrepreneur, you may then prevent them from having ideas and growth. You sterilize innovation where you just invested, which is completely counterproductive.

[ad_2]